- All

- Borrower

- Changing a loan agreement

- Eligibility

- Fees and Rates

- General

- Personal loans

- Receiving loan funds

- Repayment

- SouSou

- SouSou Fees

- Top Questions

Benefits:

(1) it is a security insurance in the event something happens to someone, in a case of death, permanent disability or job dismissal that the monies will be used to continue paying for the sou sou and protect the members,

(2) to cover the expenses of the professional services being offered such as management of the funds, payment options and to ensure that you collect your monies on time,

(3) its also a commitment and benefit for you to booking your pay cycle in the sou sou.

(4) it is cheaper than a loan.

Example:

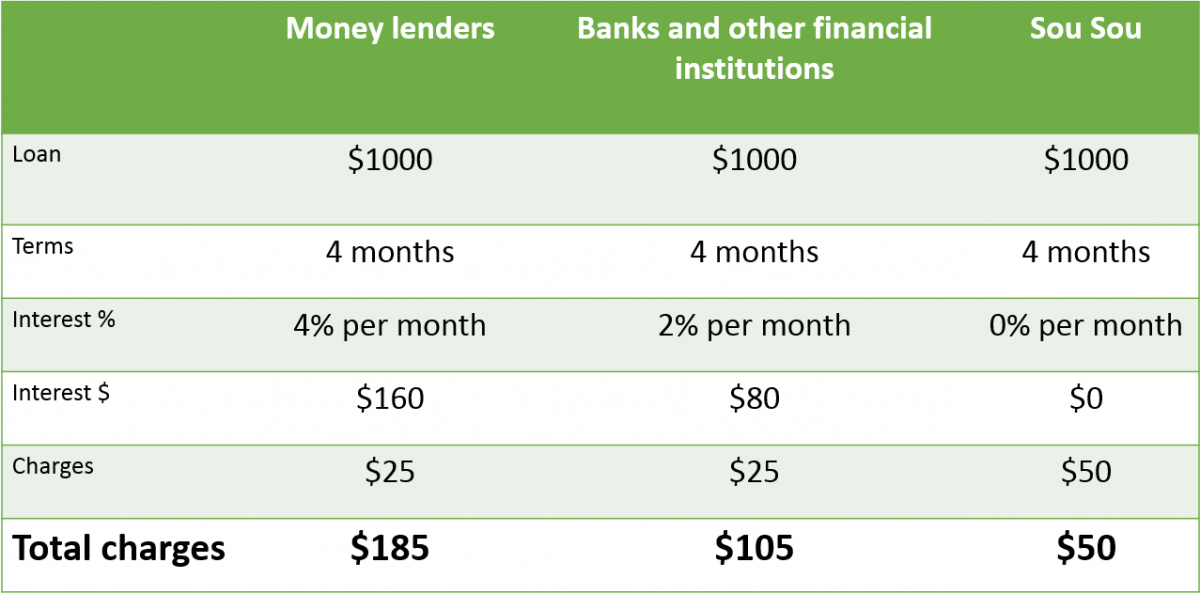

If you were to take a loan from a financial institution for $1000, from February to May, the below table shows the charges you would have to pay.

The table above shows that using a sou sou you save $135 against taking a loan with a money lender. Using a sou sou you save $55 against taking a loan with a bank or another financial institution. Most sou sous charge a booking fee and this fee is only to manage the finances of the small sou sou skillfully. Sou Sous can save other members a lot of money by the utilization of peer lending circles.

A sou sou loan is a secure and easy way to help clients build credit using peer lending cycles.

- loans can only be given to a percentage of the total amount contributed to the hand thus far. So if, a person’s hand size is $5000, and he only contributed $2000 ($500 over 4 months), then he can only get a percentage of the monies contributed thus far. If the percentage is 40%, he can only take a loan up to the amount of $800 on his contributed $2000.

- The percentage of the monies that can be loaned can vary between 10% – 40%. It will depend on various factors including credit history and the loan amount among others things.

- persons who have received their hands already cannot take a sou sou loan.

- payback of loans can be deducted from the hand size on the customers pay cycle or the customer can pay it back before.

- Interest is calculated at 4% per month, plus an origination fee of 3%. So if the hand is due in October, and you took the loan on March, the difference between months is 6 months. Thus (6 * 4%)+3% = 27%.

- loan can be paid back early for a loan rebate.

A default occurs only after you miss a monthly payment. In other words, you’d have to be delinquent for 30 days.

The repercussions of defaulting on a personal loan depend on whether it’s is secured or unsecured.

Secured personal loans are backed by collateral. If you default on a [secured] personal loan, you risk losing the assets you used as collateral. If you default on an unsecured loan, the loan might be turned over to a collection agency.

This means you could face:

- Loss of assets, such as jewelry or savings account, that serve as collateral for secured loans

- Lawsuits and charges for legal fees

- Wage garnishment, or money being taken from your paycheck after a court judgment

- Lien on a property after a court judgment, which gives the lender a legal claim on your property. When the property is sold, the lender receives a portion of the sale proceeds to satisfy the lien.

In case of payment default, the applicable interest rate is 4%/month, meaning 48% per year (APR).

What should you do if you’re in danger of defaulting?

If you’re unable to make loan payments, we will be willing to work with you to help avoid default. Talk to us about your options. Depending on your loan type, you could consider:

- Putting your loan into deferment or forbearance: We might temporarily pause your payments with deferment or forbearance.

- Entering into a repayment plan: We might be willing to rework the terms of your loan so you can afford to repay it.

- You are a Trinidadian resident.

- Proof of home address: (Cell Phone bill, Cable bill, WASA bill, Utility Bill, Bank bill etc…).

- You must be 21 years or older.

- You have at least (1) valid form of picture ID (Driver’s License, ID, Passport).

- Proof of identity. A selfie of you holding the ID.

- Proof of Income, provide last months Payslip.

- Proof of Employment, a Job Letter. You must have been employed with the same employer for the last 2 months.

- Employer does SALARY DEDUCTION.

- You must have a Trinidadian bank account, to deposit the funds into.

- Provide two (2) referrals name, address and contact. One being family and one being non family.

- If you don’t have a stable job or are unemployed.

- If the required documents are incomplete or the information you’ve sent us is incorrect.

- If you currently have several outstanding short term loans.

- If after the approval process it’s deemed that your salary will not be able to cover the loan expenses.

- If we cannot confirm your employment.

- If your employer does not accept or agree to do salary deductions.

- If we refuse the collateral you propose because it is counterfeit, stolen or not of the loan value that you request.

No. The first loan must be paid back before you can apply for a second.

It may allow you to meet unexpected expenses, unexpected events, emergencies or provide a short-term cash need between paychecks. Don’t forget, it is not made to be a long-term solution for managing your finances. Exaggerated use of short-term loans may create financial hardships. Please borrow responsibly.

Yes. You can pay off your loan anytime before your due date without any extra fees or penalties. Increasing your trust and credit worthiness with us and other community lenders.

You can fill out our online loan application, call us at 1-868-379-6915 or email us at service@loanfren.com.

Currently, we do not lend to self-employed persons. We have lent to some self-employed persons with success. Collateral is always good for negotiating. Call us at 1-868-379-6915. Lets talk.

As a responsible lender we won’t allow you to borrow more money while your account is in arrears.

If you’re experiencing difficulty repaying, you should contact us immediately on 868.379.6915. We have a range of options to help and we’ll always act fairly in response to your circumstances.

If you have a Short term loan it may be possible to borrow more by applying for a top up.

The amount you can top up will depend on your personal application limit and our credit and affordability assessment of you. We assess each top up application on an individual basis and we can’t guarantee that your application will be successful.

We can sometimes let people change their promise date (repayment date) to extend their loan.

If you can’t repay your loan on time, please call us straight away on 868 379 6915. We offer a range of options to customers having difficulty repaying, and we’ll deal with your situation in a reasonable and helpful way.

If you have a Short term loan, it may be possible to borrow a little more while keeping the same promise date (repayment date).

Short term loan top ups

The amount you can top up will depend on your personal application limit and our credit and affordability assessment of you. We assess each top up application on an individual basis and we can’t guarantee that your application will be successful.

Please be aware, you can only top up a loan once.

If approved, we’ll send the extra money in 5 minutes. Interest is charged at the same rate as your original loan.

Currently, we only accept salary deductions from your employer, we are working on implementing alternative payment methods.

LATE CHARGE. If you are more than 15 days late in paying any part of an installment, you promise to pay a late charge equal to 5% of the scheduled monthly payment.

If you can’t repay your loan on time, please call us straight away on 868 379 6915. We offer a range of options to customers having difficulty repaying, and we’ll deal with your situation in a reasonable and helpful way.

If you have a Short term loan you can apply for a repayment arrangement seven days before your repayment date or any time after your repayment date by contacting us, and filling out an income and expenditure (I&E) form. This will help us understand your financial circumstances so we can try to arrange a fair and affordable repayment plan for you. Once you’ve completed the I&E form, we’ll try to offer you a repayment plan that suits your circumstances. Alternatively, you can apply for a repayment arrangement by calling 868.379.6915 from 7am-10pm, 7 days a week.

If we can’t agree a repayment plan with you, we’ll try to reach a solution with you that takes your financial circumstances into account.

If you can’t repay your loan on time, please call us on 868.379.6915. We offer a range of options to customers having difficulty repaying, and we’ll deal with your situation in a reasonable and helpful way.

If you are due a refund, it will normally be credited to your account within five working days.

We deposit funds 24 hours a day, every day. However, you will only be able to get the funds within the bank’s business working days.

If you’ve been accepted for a loan and should have received your money, please call customer care on 868.379.6915.

Our customers are at the heart of our business and we’re committed to giving them the highest quality service we can. So if you’re not happy with our service, please let us know so we can put things right.

Complaint Resolution Process

How to contact us with a complaint

You may find it easiest to contact us by email. However you can also write to us with the details of your complaint, or telephone our customer service team.

Please remember to include these details –

- Your name

- Email address associated to your account.

- A description of your complaint, including supporting documentation

- What we can do to put things right.

By email: service@loanfren.com

Once a loan has been repaid, it can take up to an hour for your account to update. Once your account has updated, you can submit a new application. We only offer short duration loans. Our loans are not designed as a continual source of credit and will be unsuitable if you need to borrow for a longer period.

As a responsible lender we don’t encourage you to use the service frequently and timely repayment does not automatically mean we’ll offer you more money.

Even if you have repaid a loan in the past with no problem, we may be unable to offer you a loan. We consider every application on an individual basis. We never guarantee approval based on previous usage alone.

We examine a wide range of industry data and make a decision based on a combination of factors. Our system is constantly evolving and we sometimes make adjustments to ensure we lend responsibly.

If your application has been declined, we will try to include the reasons on the decision page at the end of your application. For your security, our customer care advisors don’t have access to any further information about decisions.

We don’t want our customers to have financial problems as a result of taking out a loan with us. That means we need to be careful we only lend to people who we think can afford to repay, and only lend an amount that they can manage.

So we’re changing the way we make decisions about lending, and setting additional requirements about how much we lend and the financial circumstances of people we can lend to. We have been working.

These changes will affect both new and existing customers.

How our new lending rules protect you

When you apply we will carefully assess your application, using your details, information from credit reference agencies and other sources, and your repayment record if you have borrowed from us before. Then we will use our new lending rules to make a lending decision.

We only want to offer you a loan we believe you can afford. So even if you have been a customer before and have a good repayment history you may only be accepted for a loan less than you have borrowed in the past. In some circumstances we may not be able to offer a loan at all.

If you have recently been declined, it’s likely we can’t offer you a loan just now.

You might want to think about the alternative solutions and whether you actually need to take out a loan, but if you decide that taking out a loan is the right option you can try again after 30 days.

Yes, every time you apply for a LoanFren.com loan we carry out checks with credit reference agencies to verify who you are and to help assess whether the loan is affordable. For each check we make, we leave a record, known as an application footprint. Making lots of applications for credit in a short period of time will leave multiple footprints and may indicate to lenders that you are experiencing financial difficulties.

Government of Trinidad & Tobago. LoanFren Ltd., licence money lender.

To use you must be 21 years of age or older.

We carry out a credit check as part of our automated decision making process, so if you’ve got a poor credit record it may affect our decision.

We offer a solution for occasional, urgent and short term cash needs and our loans are not designed as a continual source of credit or for dealing with existing financial problems. If you’re worried that you’re sinking into a bad debt situation, please don’t apply.

To give yourself the best chance of acceptance, make sure you give us as much information as possible – and ensure that it’s accurate – during your application. If we can’t provide you with a loan at any time we’ll always try to give you a reason for the decision, plus any actions you can take where possible.

Yes, we carry out a credit check as part of our automated decision making process. For full details about how we share information with credit reference agencies, please see our Privacy Policy.

Please ensure the information you provide in your application is true, accurate and complete so we can make an informed lending decision and are able to assess whether the loan is suitable. If you’re an existing customer you can keep your details up to date. If we can’t lend to you we’ll always try to tell you why plus any actions you can take where possible.

- Interest rate is 4%/month, meaning 48% per year (APR).

- An origination fee is added into the loan’s principle of 10%.

- A service fee of 1% is added each month to service the loan.

Clients can borrow between $100 – $1000, if they opt to repay via salary reduction.

If clients prefer to pay via alternative methods we propose the offering of collateral.

Some more things to think about

We set individual application limits as part of our commitment to responsible lending. They are not designed so you can rapidly increase the size of loans, and approval of your next application is never guaranteed.

The amount of money you are able to apply for may change and we will always carry out our usual checks, including a credit check, when you apply for a loan.

We only offer short duration loans. Our loans are not designed as a continual source of credit and will be unsuitable if you need to borrow for a longer period.

You will need a valid bank account that accepts ACH debit and credit transactions.

- You must reside in Trinidad & Tobago,

- with proof of address,

- be at least 21 years of age.

- have at least one form of I.D.

- be employed,

- provide a recent payslip and job letter,

- employer must be willing to do a salary deduction,

- have an active and valid bank account, to deposit the funds

* All signed loan agreements are subject to verification of prior loan history and application data.

Everyone is welcomed! Once a salary deduction can be done, we can offer you a loan.

You may rescind your loan at no charge as long as you return the loan proceeds within the number of days specified in your loan agreement.

We know this loan is important to you, so we work hard to get it to you quickly, most often the following business day!

Before we can fund your loan it needs to be approved. Loan approval could be instant or could take up to two business days.

After your loan is approved, the amount of time it takes to transfer your money depends on your bank. It could be as soon as the same-day or as long as three business days. Most banks will post the funds to your account by the next business day.

The exact funding time will depend on your bank.

The types of personal information we collect and share depend on the product or service you have with us. Click here for more info.

You need to contact us straight away. We always want to help you if you’re having financial difficulties and we’ll always try to find a solution that works for both of us.

If you can’t pay back, call us. We’re here to help

868.379.6915

24 hours a day, every day.

The important thing is to call us as soon as possible.

LATE CHARGE. If you are more than 15 days late in paying any part of an installment, you promise to

pay a late charge equal to 5% of the scheduled monthly payment.

We may report late payment to credit reference agencies and other community lenders, which may affect your credit rating, and make getting a loan more difficult and more expensive in the future. It can also affect you for getting Visas.

LoanFren Ltd. was incorporated 22nd February 2017 as micro-payments/money lending service, with registered office Pole 2b, Cameron Rd. Petit Valley. Licensed money lenders that are determined to serve.